Two days ago, I saw the interview that David did on the Diary of a CEO, and I have to say that it took me by surprise as he develops his idea of financial independence with a sense of “Start now, improve later”, with the idea to push the viewers into start changing their future even if they don’t have the recommended means to do it. Over 7 million people have purchased David Bach’s books, yet 60% of Americans still live paycheck to paycheck with less than $1,000 in savings. The David Bach personal finance vision could change that reality—if people actually understood and implemented it from an investment perspective.

I’ve studied countless personal finance philosophies throughout my career, from Ramsey’s debt snowball to Kiyosaki’s real estate focus. But the David Bach personal finance vision stands apart because it transforms investing from something requiring “discipline” into something that happens automatically, whether you’re disciplined or not.

This comprehensive guide breaks down this idea through an investment lens. You’ll discover how his automation-first approach compounds wealth, why his “Latte Factor” is fundamentally about opportunity cost, and how to implement the David Bach personal finance vision to build a seven-figure investment portfolio.

Whether you’re skeptical of simple solutions or exhausted by complicated investment strategies, understanding the Bach personal finance vision will reshape how you think about building wealth.

Understanding the David Bach Personal Finance Vision

The David Bach personal finance vision rests on one revolutionary premise: you don’t need discipline to become wealthy—you need automation.

According to David Bach personal finance vision, the reason most people fail financially isn’t lack of knowledge or insufficient income. It’s that they rely on willpower, which psychologists call “ego depletion.” Your discipline is a muscle that gets tired. This approach removes the need for that muscle entirely.

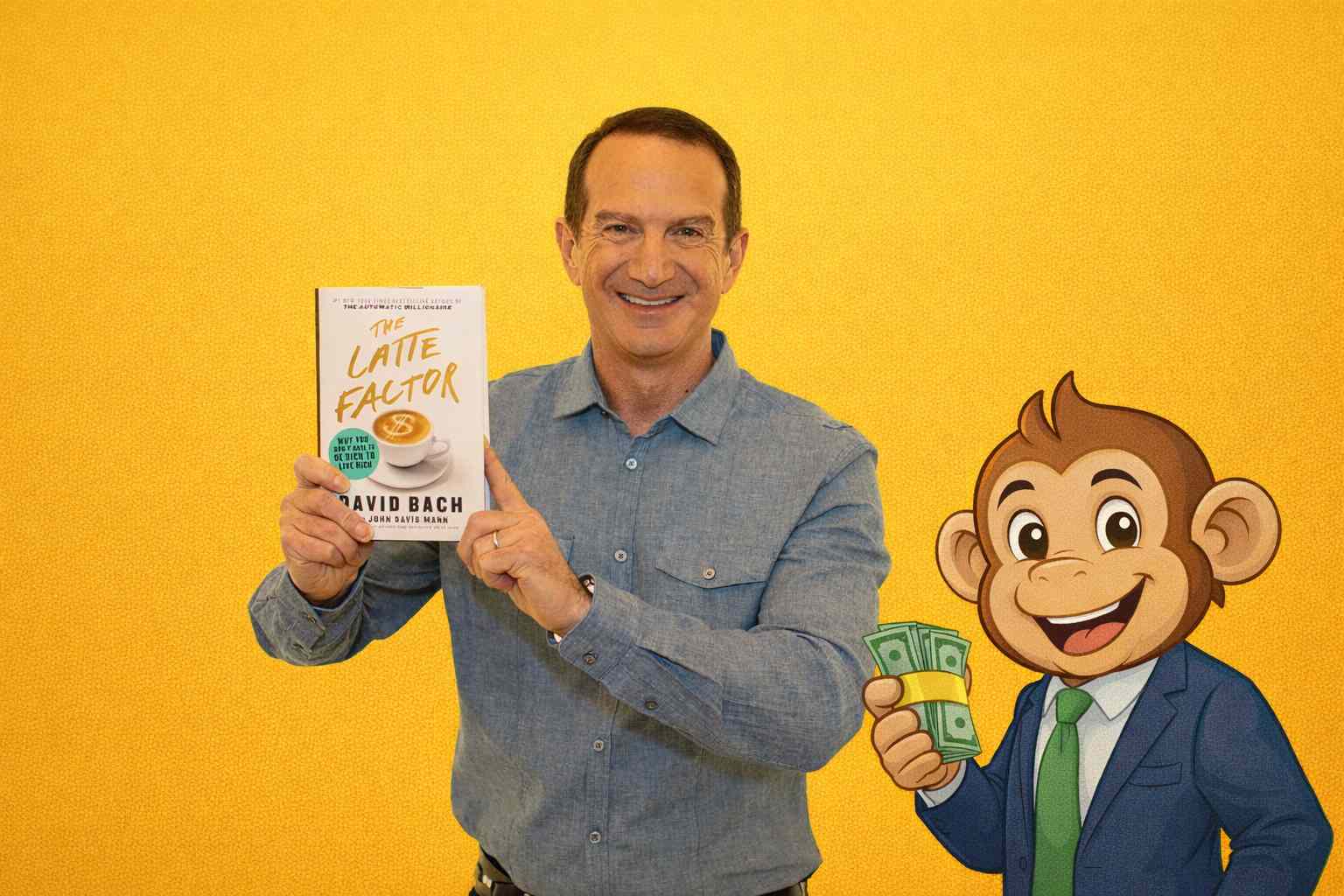

Core Principles of the David Bach Personal Finance Vision

David Bach’s vision crystallizes into seven fundamental principles that guide all investment decisions:

You don’t need to make a lot of money to be rich: The David Bach personal finance vision emphasizes that average earners can build wealth through consistent investing, not income optimization alone.

You don’t need discipline: The David Bach personal finance vision automates investments so your behavior can’t derail your wealth-building.

You don’t need to be your own boss: The David Bach personal finance vision proves employees can achieve financial independence through systematic investing.

Apply the Latte Factor: The David Bach personal finance vision uses this concept to identify investment capital hiding in daily spending.

Pay yourself first: The David Bach personal finance vision prioritizes automated investing over all other expenses.

Become a homeowner: The David Bach personal finance vision treats real estate as forced savings and leveraged investment.

Above all, automate everything: The David Bach personal finance vision makes failure impossible through systematic automation.

From an investment perspective, the David Bach personal finance vision transforms personal finance from active management to passive systems.

The Investment Philosophy Behind the David Bach Personal Finance Vision

Let’s examine the David Bach personal finance vision through a pure investment lens, because that’s where the magic happens.

Pay Yourself First: The Investment Foundation

The cornerstone of the David Bach personal finance vision is “paying yourself first”—automatically directing money to investments before paying any other bills.

According to the David Bach personal finance vision, the rich get rich because they pay themselves first. This isn’t just philosophy; it’s investment strategy. When you automate 10-15% of gross income into retirement accounts, the David Bach personal finance vision ensures you’re building wealth regardless of spending elsewhere.

Here’s why the David Bach personal finance vision makes this non-negotiable: if you wait to invest what’s “left over” at month’s end, there’s never anything left. The David Bach personal finance vision flips this—invest first, live on the rest.

From an investment standpoint, the David Bach personal finance vision leverages behavioral economics. You never miss money you never see. Automated investing before you receive your paycheck means the David Bach personal finance vision bypasses your conscious spending decisions entirely.

The Power of Pre-Tax Investing

The David Bach personal finance vision emphasizes investing in pre-tax retirement accounts (401(k)s, traditional IRAs, 403(b)s) as the fastest wealth-building tool available.

Why does the David Bach personal finance vision prioritize pre-tax accounts? Because you’re investing with money that would otherwise go to taxes. If you’re in the 25% tax bracket, the David Bach personal finance vision lets you invest $1 for every 75 cents of take-home pay reduction.

Example from the David Bach personal finance vision:

- $500/month automated to 401(k) = $6,000 annual investment

- Your take-home pay only drops by approximately $375/month (25% tax savings)

- After 30 years at 8% returns, the David Bach personal finance vision delivers $679,000

- You invested $135,000 in after-tax dollars but built $679,000

This is the math behind the David Bach personal finance vision. It’s not magic—it’s systematic tax-advantaged investing.

The Latte Factor: Investment Opportunity Cost

Perhaps the most misunderstood element of the David Bach personal finance vision is the Latte Factor®. Critics dismiss it as “telling people to give up coffee.” That completely misses the investment insight.

What the Latte Factor Really Means

In the David Bach personal finance vision, the Latte Factor isn’t about lattes at all. It’s about identifying small daily expenses that could become large investments through opportunity cost analysis.

The David Bach personal finance vision calculates: $5 daily on coffee × 365 days = $1,825 annually. But here’s where the David Bach personal finance vision gets powerful: invest that $1,825 annually at 8% for 30 years, and you have $223,200.

That’s not hyperbole. That’s compound interest—the foundation of the David Bach personal finance vision.

From an investment perspective, the David Bach personal finance vision teaches that every dollar spent is a dollar not invested. The Latte Factor helps identify these opportunity costs across your spending, revealing investment capital you didn’t know you had.

The Latte Factor Challenge

The David Bach personal finance vision includes a one-week tracking exercise: monitor every expenditure to identify your personal Latte Factor—those recurring small purchases that could become investments instead.

According to the David Bach personal finance vision, most people discover $5-$15 daily in Latte Factor spending. That’s $150-$450 monthly, or $1,800-$5,400 annually that could be redirected to investments.

The David Bach personal finance vision isn’t about deprivation. It’s about conscious choices: would you rather have daily coffee, or $223,000 in 30 years? The David Bach personal finance vision respects either answer—it just demands you make an informed choice.

Automation: The Secret Weapon of the David Bach Personal Finance Vision

If I had to identify the single most important element of the David Bach personal finance vision, it’s automation. This is what separates his philosophy from every other investment philosophy.

Why Automation Matters for Investing

His philosophy recognizes that humans are terrible at consistent behavior. We’re emotional, impulsive, and easily distracted. The David Bach personal finance vision works WITH human nature, not against it.

When you automate investing—setting up automatic transfers from checking to investment accounts on the day you’re paid—the David Bach personal finance vision removes you from the equation. You can’t forget. You can’t procrastinate. You can’t spend it first.

According to research supporting his ideas, people who automate their investments are 3-5 times more likely to reach their retirement goals than those who invest “when they remember.”

Implementing Investment Automation

Bach provides a specific automation sequence:

Step 1: Enroll in employer 401(k) with automatic payroll deduction. Bach recommends starting with whatever gets full employer match, then increasing 1% annually.

Step 2: Set up automatic IRA contributions directly from checking account. This idea suggests the day after payday.

Step 3: Automate additional investment account funding (taxable brokerage for goals beyond retirement). David stresses that automation works for all investment vehicles.

Step 4: Automate extra mortgage principal payments. Treat this as a forced equity investment in your home.

Following the automation protocol means you’re building wealth in your sleep.

The Homeownership Component

One controversial element of the David Bach vision is its emphasis on homeownership as wealth-building strategy.

Why He Favors Homeowners

According to Bach: “Homeowners get rich; renters get poor.” This isn’t a moral judgment—it’s investment math.

David views homeownership as leveraged forced savings. You’re investing with the bank’s money (mortgage), building equity automatically with each payment, and benefiting from potential appreciation.

From an investment perspective, the David Bach personal finance vision recognizes that homeowners build net worth even when they’re not trying. Renters must consciously invest; homeowners invest automatically through mortgage payments.

The numbers behind his personal finance vision:

- Average homeowner net worth: $255,000

- Average renter net worth: $6,300

- Homeownership creates 40x wealth advantage over renting

However, critics rightly note that his vision oversimplifies homeownership. Not every market, situation, or person benefits from homeownership. This philosophy works best when you’re committed to staying 5+ years in appreciating markets.

Accelerating Home Equity Investment

This philosophy doesn’t stop at ownership—it advocates automating extra principal payments.

According to David, paying one extra mortgage payment annually (divided into 12 monthly additions) can shorten a 30-year mortgage to 23-24 years while saving six figures in interest.

From an investment standpoint, the David Bach personal finance vision treats mortgage acceleration as a guaranteed return equal to your interest rate. If your mortgage is 6.5%, extra principal payments “earn” 6.5% guaranteed, tax-free return.

Investment Allocation in the David Bach Approach

How does the David Bach personal finance vision recommend investing the money you’re automatically saving?

The Simplicity Approach

This vision favors simple, low-cost investing over complex strategies. This isn’t because he underestimates investor intelligence—it’s because complexity creates failure points.

According to David most investors should use target-date retirement funds or simple three-fund portfolios:

- U.S. stock index fund (60-70%)

- International stock index fund (20-30%)

- Bond index fund (10-20%, increasing with age)

The David Bach personal finance vision argues that trying to beat the market through stock picking or market timing fails 90% of the time. Better to automate investments into diversified index funds and let compound interest work.

Age-Based Allocation

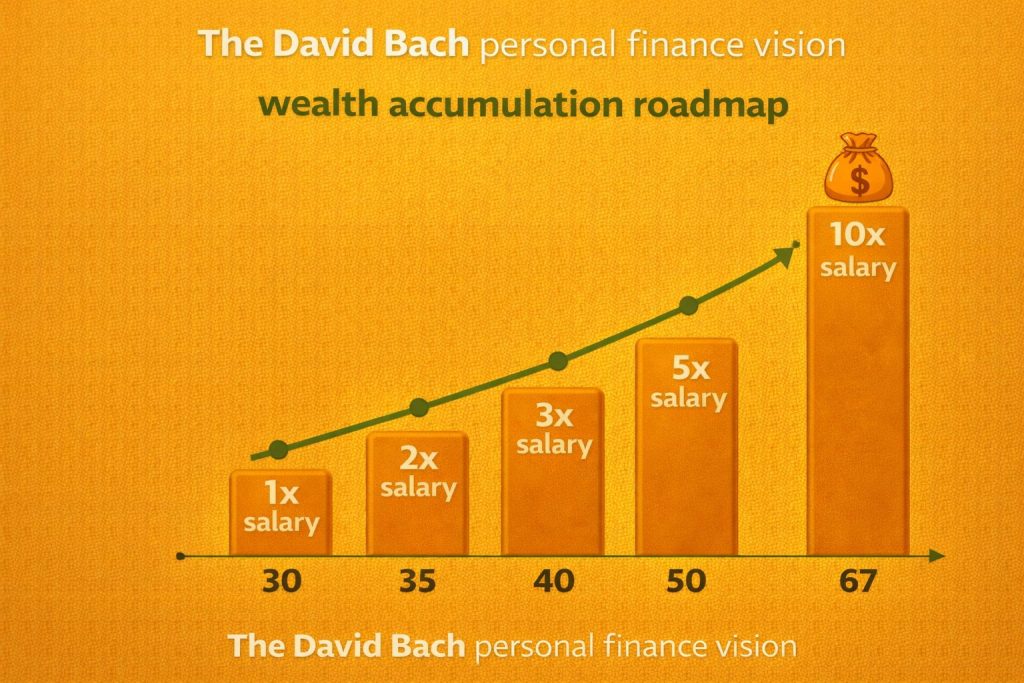

David Bach philosophy aligns with Fidelity’s age-based roadmap for investment accumulation:

- Age 30: 1x starting salary invested

- Age 35: 2x starting salary invested

- Age 40: 3x starting salary invested

- Age 50: 6x starting salary invested

- Age 60: 8x starting salary invested

- Age 67: 10x starting salary invested

Following the automation principles, these milestones become achievable for average earners investing 10-15% of income.

How Much to Invest: The David Bach’s Formula

David Bach provides clear investment percentages based on financial goals:

Dead Broke: Spending more than you make (negative investment rate)

Poor: Spending everything, saving nothing (0% investment rate)

Middle Class: Paying yourself first 5-10% of gross income

Upper Middle Class: Paying yourself first 10-15% of gross income

Rich: Paying yourself first 15-20% of gross income

Your financial class is determined not by income but by investment rate. Someone earning $50,000 who invests 15% is wealthier than someone earning $200,000 who invests nothing.

David emphasizes that moving from 0% to 5% investment rate is more impactful than moving from $50,000 to $100,000 income. Investment rate matters more than income level.

Compound Interest: The Magic Behind the vision

The entire David Bach personal finance vision rests on compound interest—what Einstein allegedly called “the eighth wonder of the world.”

Time Value of Money

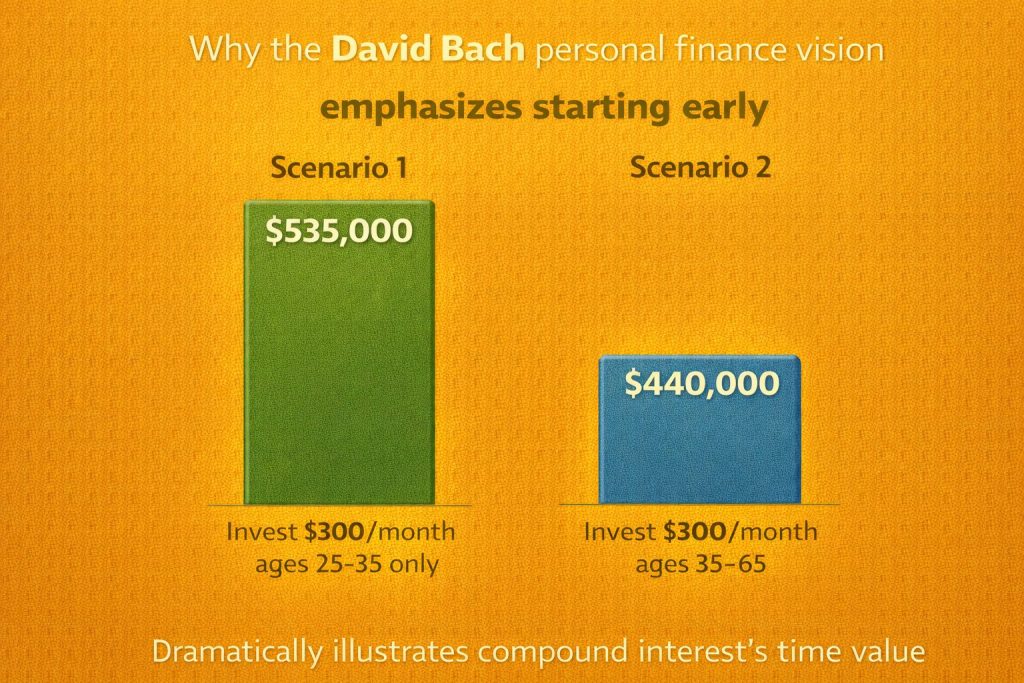

The David Bach personal finance vision uses vivid examples to illustrate compound interest power:

Scenario 1: Invest $10 daily ($300 monthly) from age 25-35 (10 years), then stop. Never add another dollar. At 8% annual returns, by age 65 the David Bach personal finance vision shows you’ll have $535,000.

Scenario 2: Wait until age 35 to start investing $10 daily. Continue until age 65 (30 years of investing vs. 10 years in Scenario 1). This reveals you’ll have only $440,000—despite investing three times longer!

This is why David Bach obsesses over starting NOW, not waiting until you “make more money.” The early years of investing are the most valuable years.

The Automatic Millionaire Math

Bach made famous the “couple who became millionaires on average income” story:

- Combined household income: $55,000 annually

- Investment rate: 10-15% automatically deducted

- Starting age: mid-20s

- Retirement age: mid-50s

- Net worth at retirement: $2+ million

This is his philosophy in action.

Not lottery winners.

Not entrepreneurs.

Not high earners.

Average people who automated their investments and let compound interest work for 30+ years.

Tax Optimization

Recognize that taxes are the biggest wealth destroyer for investors, so it emphasizes tax-advantaged investing.

Retirement Account Priority

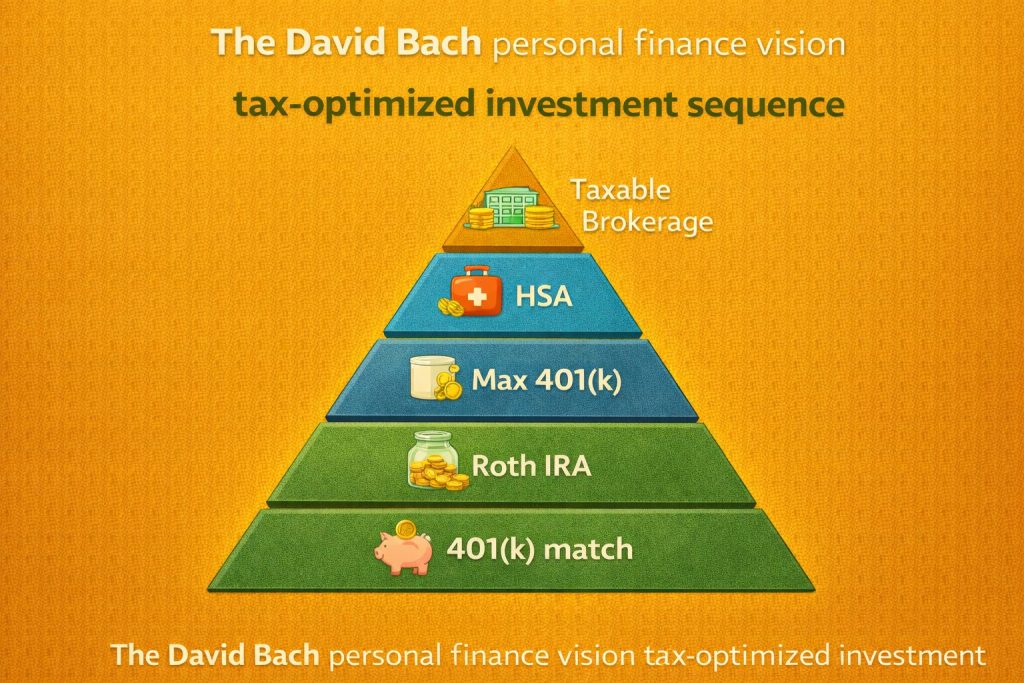

David creates a specific priority sequence for automated investing:

First priority: Contribute to employer 401(k) up to full company match. According to David, this is “free money”—instant 50-100% return on investment.

Second priority: Max out Roth IRA ($6,500 annually, or $7,500 if 50+). David loves Roth IRAs because withdrawals in retirement are completely tax-free.

Third priority: Return to 401(k) and contribute the maximum ($22,500 annually, or $30,000 if 50+). The idea is to maximize pre-tax space before moving to taxable accounts.

Fourth priority: Fund Health Savings Account (HSA) if eligible. The David Bach personal finance vision calls this the “triple tax advantage”—contributions are pre-tax, growth is tax-free, and withdrawals for medical expenses are tax-free.

Fifth priority: Invest in taxable brokerage accounts. Here, he only recommends this after maxing all tax-advantaged spaces.

Following this sequence minimizes lifetime taxes on investment growth.

The Investment Timeline of the David Bach Personal Finance Vision

This isn’t a get-rich-quick scheme. It’s get-rich-guaranteed over time.

Short-Term (Years 1-5)

In the early years,focus on building habits and systems:

- Automate at least 10% of gross income to investments

- Establish emergency fund of 3-6 months expenses

- If purchasing a home, save automated down payment

- Maximize employer 401(k) match

- Open and fund Roth IRA

These foundational years establish systems that will compound for decades.

Medium-Term (Years 5-15)

Accelerates during this phase:

- Increase automated investment rate by 1% annually

- Investment balances begin meaningful growth through compound interest

- Focus on maxing out 401(k) contributions

- Automate extra mortgage principal payments

- Begin seeing actual wealth accumulation (six-figure net worth becomes visible)

The David Bach personal finance vision recognizes that years 5-15 are where believers emerge—you can actually see your automated systems working.

Long-Term (Years 15-30+)

Delivers exponential results in later years:

- Compound interest becomes the primary driver of wealth growth

- Your contributions matter less; investment returns matter more

- Automated systems have run for decades without intervention

- Seven-figure net worth becomes realistic for average earners

- Financial freedom and early retirement become possible

The importance here is patience during years 15-30 because that creates life-changing wealth.

Common Criticisms of the Bach Vision

No investment philosophy is perfect. Let’s examine fair criticisms of this philosophy

Criticism 1: The Latte Factor Is Oversimplified

Critics argue that Bach wrongly suggests small spending changes create wealth, when income growth matters more.

Fair point: The David Bach personal finance vision does sometimes overemphasize cutting small expenses versus earning more. However, the core insight remains valid from an investment perspective—small amounts invested consistently create substantial wealth through compound interest.

Rebuttal: The David Bach personal finance vision isn’t anti-income growth; it simply recognizes that most people can find $5-$15 daily to invest RIGHT NOW without waiting for raises.

Criticism 2: Homeownership Isn’t Always Best

Critics note these ideas oversimplify “homeowners get rich; renters get poor.”

Fair point: The David Bach personal finance vision undersells homeownership costs, market risks, and situations where renting is financially superior. Renters who invest the difference between rent and ownership costs can build equal or greater wealth.

Rebuttal: While this vision is too absolute about homeownership, the forced savings aspect remains valuable for people who won’t otherwise invest. Imperfect forced investment beats perfect plans never executed.

Criticism 3: Returns Assumptions May Be Optimistic

This vision frequently uses 8-10% annual investment returns in examples. Critics argue this is too optimistic.

Fair point: Historical S&P 500 returns average about 10%, but future returns may be lower. The David Bach personal finance vision examples could use more conservative 6-7% assumptions.

Rebuttal: Even at 6% returns, these automation principles still build substantial wealth—just slower than the examples show. The system works; the timeline just extends.

The Bottom Line on the David Bach Personal Finance Vision

The David Bach personal finance vision offers something rare in personal finance: a simple, systematic approach that actually works for average investors.

From an investment perspective, the David Bach personal finance vision succeeds because it aligns with how humans actually behave. We’re not rational calculators—we’re emotional, impulsive beings who need systems that work despite our nature, not because of it.

The David Bach personal finance vision automation principle is brilliant. By removing conscious decision-making from investing, the system ensures consistency. You can’t fail to invest if the money never reaches your checking account.

The David Bach personal finance vision emphasis on compound interest is mathematically sound. Small amounts invested consistently over decades become substantial wealth—this is proven, not speculative.

The David Bach personal finance vision pre-tax retirement account priority is correct. Most investors should maximize tax-advantaged space before moving to taxable accounts.

Where the David Bach personal finance vision deserves criticism is in oversimplifying certain elements—particularly homeownership and return assumptions. Not everyone should buy homes, and 8-10% returns aren’t guaranteed.

But these are minor flaws in an otherwise solid investment philosophy. The David Bach personal finance vision has genuinely helped millions build wealth who otherwise wouldn’t have. The testimonials aren’t fabricated—people really have become millionaires following this system.

My assessment: The David Bach personal finance vision works best for:

- Average income earners ($40,000-$100,000)

- People who struggle with financial discipline

- Investors seeking simplicity over optimization

- Anyone willing to commit 10-15% of income to automated investing

- Long-term thinkers (10+ year investment horizons)

The David Bach personal finance vision works less well for:

- High earners who can optimize more sophisticated strategies

- Highly disciplined investors who don’t need automation

- People in unstable employment or income situations

- Short-term wealth seekers

- Those unwilling to commit to homeownership (a key pillar)

Overall, this ideas deserves its place in the personal finance pantheon. It’s not perfect, but it’s practical, proven, and powerful when implemented consistently.

The key insight from Bach: you probably don’t have an income problem; you have an automation problem. Start automatically investing 10% of your income today, increase it 1% annually, and let the system run for 30 years. The David Bach personal finance vision promises you’ll be wealthy—and the math backs it up.

That’s the honest assessment every investor considering the David Bach personal finance vision deserves.

Frequently Asked Questions About David Bach

Can David Bach Ideas work for low-income earners, or does it require a certain minimum income?

These ideas absolutely works for low-income earners—in fact, it was specifically designed for average Americans, not high earners. The philosophy demonstrates that a couple earning $55,000 combined annual income retired as multi-millionaires by following the automation principles.

However, these philosophies require some minimum financial stability: you need enough income to cover basic necessities (housing, food, transportation) with something left over to invest. If you’re truly struggling to afford essentials, David recommends first addressing immediate survival needs, then implementing the investment automation once you have even $25-$50 monthly available.

The key insight from Bach is that wealth-building isn’t about how much you earn—it’s about what percentage you automatically invest. Someone earning $35,000 who automates 10% ($3,500 annually) can build more wealth over 30 years than someone earning $100,000 who saves nothing.

Small amounts invested consistently through automation create substantial wealth through compound interest. Start with whatever you can—even $50 monthly—and the David Bach personal finance vision recommends increasing by 1% of income annually until you reach 10-15% automated investment rate.

How does the David Bach’s advice compare to other investment philosophies like index fund investing or real estate focus?

This is actually complementary to most other investment philosophies rather than contradictory. Unlike philosophies that focus primarily on WHAT to invest in, Bach focuses on HOW to ensure you actually invest consistently—through automation.

The philosophy is agnostic about specific investment vehicles, favoring simple low-cost index funds for most investors while also emphasizing homeownership. This aligns perfectly with passive index fund investing advocated by Bogle and Buffett—Bach just adds the automation layer that ensures you consistently buy those index funds regardless of market conditions.

Where this vision differs from real estate-focused philosophies (like Kiyosaki’s) is in emphasizing primary residence homeownership and retirement account investing over income-producing rental properties. Here is more conservative and accessible to average investors who can’t necessarily qualify for investment property mortgages.

The unique contribution of Bach’s personal finance vision to the investment world is behavioral—it solves the consistency problem that destroys most investment strategies. You can combine the David Bach personal finance vision automation principles with almost any other investment philosophy: automate investments into index funds, automate investments into dividend stocks, automate savings for real estate down payments. The automation is the key, and that’s the contribution that other philosophies often overlook.

What if I’m starting to implement the David Bach personal finance vision in my 40s or 50s—is it too late to build wealth?

While the David Bach personal finance vision delivers maximum results when started in your 20s or early 30s, it absolutely still works when started later—you just need to adjust expectations and potentially increase investment rates. The philosophy emphasizes that starting late is infinitely better than never starting at all. If you’re implementing the David Bach personal finance vision at age 40, you have 25-27 years until traditional retirement age—still enough time for compound interest to work powerfully, especially if you increase your automated investment rate above the standard 10-15%.

Bach recommends that late starters aim for 15-20% automated investment rate to compensate for lost time. At 50, you have catch-up contribution opportunities in retirement accounts: 401(k) catch-up allows an extra $7,500 annually ($30,000 total), and IRA catch-up allows an extra $1,000 annually ($7,500 total).

Bach encourages maximizing these catch-up provisions through automation. Realistically, someone starting the David Bach personal finance vision at 40-50 might not reach multi-millionaire status by 65, but they can absolutely build $300,000-$700,000 net worth depending on income and investment rate—dramatically better than the near-zero savings most Americans have at retirement. This works at any age because the principles (automation, paying yourself first, compound interest) remain mathematically sound regardless of when you start. Don’t let perfect (starting at 25) be the enemy of good (starting today).

How should I balance the emphasis on investing with the need to pay off high-interest debt like credit cards?

This idea addresses debt but emphasizes it differently than some other philosophies. While Dave Ramsey’s philosophy says pay off all debt before investing anything, the David Bach personal finance vision takes a more nuanced approach focused on mathematical optimization and behavioral sustainability. According to the principles, you should simultaneously address high-interest debt AND capture “free money” from employer 401(k) matches. The David Bach personal finance vision recommends this priority sequence:

(1) Contribute to 401(k) up to full employer match (this is instant 50-100% return),

(2) Aggressively pay off credit card debt and other high-interest loans (anything above 7-8% interest),

(3) Once high-interest debt is eliminated, increase automated retirement contributions,

(4) Address moderate-interest debt (4-7%) while continuing to invest,

(5) Don’t accelerate low-interest debt (under 4%) at the expense of investing.

Bach recognizes that compound interest works both ways—debt compounds against you while investments compound for you. High-interest debt (15-25% credit cards) grows faster than typical investment returns, so eliminating it comes first after capturing the employer match.

However, David Bach warns against the all-or-nothing approach of paying every penny toward debt while investing nothing—you lose years of compound growth and employer match money. The behavioral advantage of David Bach’s approach is that you see investment account growth even while paying debt, providing motivation to continue. Once debt is cleared, simply redirect those automated debt payments to increased automated investing—the habit is already established.

What are the biggest mistakes people make when trying to implement this advice, and how can I avoid them?

The biggest mistake people make with the David Bach personal finance vision is understanding the philosophy intellectually but never actually setting up the automation—essentially treating it like information rather than action. These advices only works when you physically establish automatic transfers from paycheck to investment accounts; merely intending to “start investing more” accomplishes nothing. The second major mistake is starting with an unsustainably high investment rate that forces you to cancel automation within months.

David recommends starting with whatever feels manageable (even 5%) and increasing 1% annually rather than trying to immediately jump to 15% and failing.

The third critical error is abandoning investments during market downturns. When accounts lose value during recessions, people panic and stop automated investments—exactly the wrong move since they’re now buying investments “on sale.” This automation specifically prevents this by removing emotion from investment decisions.

The fourth mistake is implementing automation but then constantly tinkering with investments, trying to time markets or pick hot stocks. This approach succeeds through boring consistency, not exciting stock picks. Set up automatic investments into simple index funds and don’t touch them for decades.

The fifth error is treating this approach as complete financial planning. The philosophy doesn’t adequately address insurance needs, estate planning, tax optimization beyond retirement accounts, or many other important financial topics. Use this as your investment automation framework, but supplement it with proper insurance, wills, and potentially professional financial planning for complex situations. The solution to all these mistakes: take action today (set up one automatic investment), start small but start now, never cancel automation regardless of market conditions, resist the temptation to constantly adjust, and view this as one component of comprehensive financial planning rather than the complete solution.