Getting an instant cash advance can feel like the fastest solution when money is tight, but it’s not always the right one.

Based on my experience reviewing cash advance apps and short-term financial tools, instant advances work best for temporary cash gaps—not ongoing financial problems.

This guide explains:

- How instant cash advances actually work

- When they make sense — and when they don’t

- Safer alternatives if you need cash quickly

I’m going to walk you through everything you need to know about getting cash in your hands quickly. We’ll explore multiple options, break down the real costs, and help you make the smartest choice for your situation.

Who this guide is for

- People facing a short-term cash gap

- Users with steady income who can repay quickly

- Those comparing instant cash advance options responsibly

Who should avoid instant cash advances

- Anyone relying on advances repeatedly

- Users without predictable income

- Those already struggling with multiple short-term debts

What Exactly Is an Instant Cash Advance?

An instant cash advance is a short-term loan that provides immediate access to funds. Simple as that.

These advances typically range from $100 to $5,000, depending on your income and the provider’s policies. The “instant” part means you can often receive approval and funding within minutes to a few hours, rather than waiting days for traditional loans.

But here’s the catch – speed comes at a price. Interest rates and fees are usually higher than conventional loans because lenders take on more risk with quick approvals.

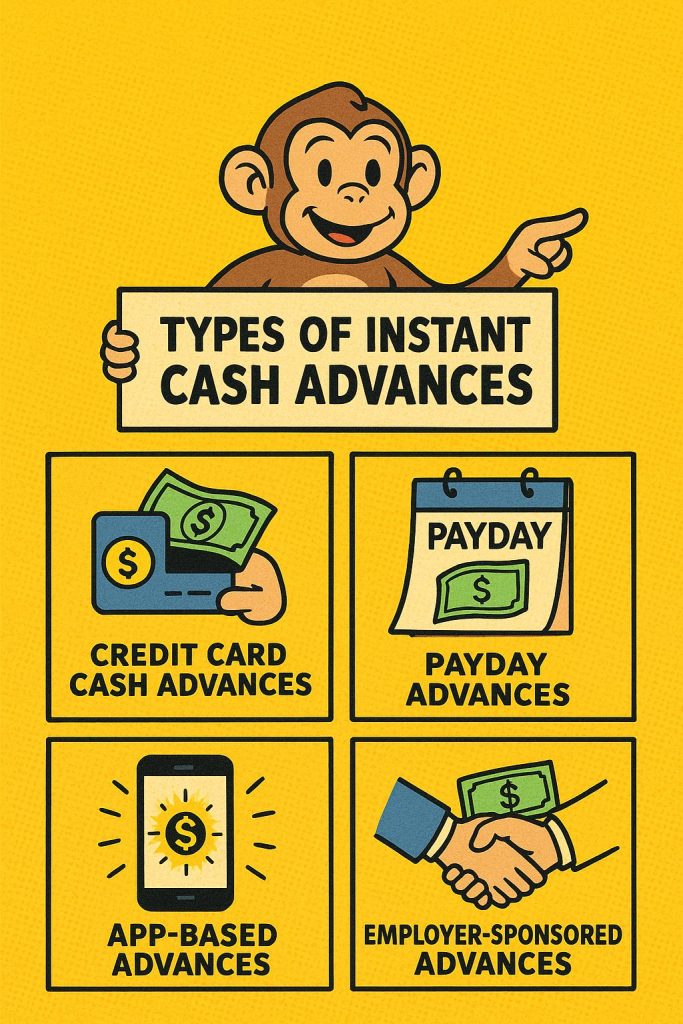

Types of Instant Cash Advances

Credit Card Cash Advances Your credit card company allows you to withdraw cash against your credit limit. It’s convenient but expensive.

Payday Advances Short-term loans based on your upcoming paycheck. These are notorious for high fees but offer quick access to funds.

App-Based Advances Modern fintech companies offer cash advances through mobile applications. They’re often more affordable than traditional payday loans.

Employer-Sponsored Advances Some employers partner with services that let you access your earned wages before payday.

How Can I Get an Instant Cash Advance?

Let me break down your fastest options for getting cash right now.

Method 1: Credit Card Instant Cash Advance

This is often your quickest option if you have an existing credit card.

Step-by-step process:

- Check your available cash advance limit (usually lower than your credit limit)

- Visit any ATM that accepts your card

- Insert your card and select “cash advance”

- Enter your PIN and withdrawal amount

- Take your cash and receipt

Timeline: Immediate at ATMs, or within hours for online requests

Pros:

- Instant access at thousands of ATMs

- No application process required

- Uses existing credit relationship

Cons:

- High interest rates (often 25-30% APR)

- Cash advance fees (typically 3-5% of the amount)

- Interest starts immediately (no grace period)

- Lower credit limits for cash advances

Method 2: Mobile Instant Cash Advance Apps

These apps have revolutionized quick access to funds. Popular options include Dave, Earnin, MoneyLion, and Chime SpotMe.

How it works:

- Download the app and create an account

- Connect your bank account for verification

- Provide employment information

- Request an advance (usually $20-$500)

- Receive funds via direct deposit or instant transfer

Timeline: 1-3 hours for instant transfers, next business day for standard transfers

Example with Earnin:

- Link your bank account and provide work schedule

- Track your hours worked

- Request up to $500 per day ($100 daily for new users)

- Pay a small “tip” instead of interest

Pros:

- Lower fees than traditional payday loans

- Some offer interest-free advances

- Easy mobile interface

- Quick approval process

Cons:

- Limited advance amounts

- Requires steady employment

- May need to provide location data

- Automatic repayment can cause overdrafts

Method 3: Online Payday Lenders

Traditional payday lenders have moved online, offering faster processing than storefront locations.

The process:

- Fill out online application (5-10 minutes)

- Provide bank account and employment details

- Upload required documents (pay stubs, bank statements)

- Receive approval decision within minutes

- Funds deposited within 1-24 hours

Timeline: Same day to next business day

Requirements typically include:

- Active checking account

- Regular income ($1,000+ monthly)

- Valid ID and contact information

- Age 18 or older

Warning: Payday loans can trap you in cycles of debt. The average borrower stays in debt for five months out of the year and pays more in fees than the original loan amount.

Method 4: Buy Now, Pay Later Services

While not traditional cash advances, these services can help with immediate expenses.

How it works:

- Make purchases and split payments over time

- Some services offer virtual cards for any purchase

- Others work with specific retailers

Popular services:

- Klarna (4 payments over 6 weeks)

- Afterpay (4 bi-weekly payments)

- Sezzle (4 payments over 6 weeks)

- Zip (formerly Quadpay)

Method 5: Peer-to-Peer Instant Cash Advances

Some platforms connect borrowers directly with individual lenders.

Examples include:

- LendingClub (personal loans, not instant)

- Kiva (microloans, slower process)

- Various Facebook groups and local community boards

Caution: Be extremely careful with informal lending arrangements. Scams are common, and you have little legal protection.

How Can I Get an Instant Cash Advance Through Different Channels?

Let me dive deeper into specific strategies for each major channel.

Banking Relationships

Your Current Bank Many banks offer overdraft protection or lines of credit to existing customers. Call your bank directly – they might have options not advertised online.

Credit Unions If you’re a member, credit unions often provide:

- Payday Alternative Loans (PALs) with better rates

- Emergency loans for members

- Faster processing for existing relationships

Online Banks Digital banks like Chime, Varo, and Current offer:

- Early paycheck access (up to 2 days early)

- Small overdraft coverage

- Fee-free or low-fee cash advances

Employer-Based Solutions

Payroll Advances Ask your HR department about:

- Emergency hardship programs

- Payroll advances against future earnings

- Employee assistance programs

Third-Party Employer Partners Many companies now partner with services like:

- DailyPay (access earned wages daily)

- PayActiv (withdraw earned but unpaid wages)

- Flexible (formerly FlexWage)

Gig Economy Platforms

If you work for gig companies, many offer instant pay options:

Uber/Lyft: Instant Pay feature (small fee applies)

DoorDash: Fast Pay for immediate earnings transfer

Instacart: Instant Cashout available daily

Amazon Flex: Instant pay after completing deliveries

Credit Building Apps with Cash Features

Some credit-building apps also offer cash advances:

Self: Offers secured credit cards and small loans Kikoff: Credit building with small purchase power Chime Credit Builder: Virtual credit card with spending power

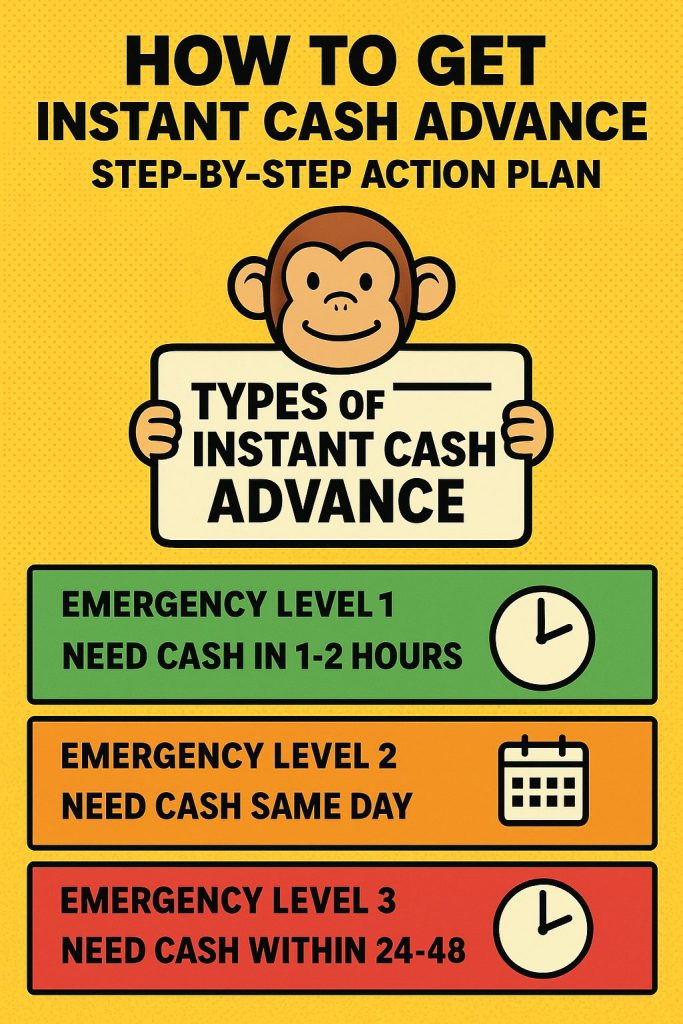

How to Get Instant Cash Advance: Step-by-Step Action Plan

Here’s your complete roadmap to getting cash fast, organized by urgency level.

Emergency Level 1: Need Cash in 1-2 Hours

Your immediate options:

- Credit card cash advance at ATM

- Locate nearest ATM using your card’s app

- Check cash advance limit beforehand

- Bring valid ID as backup

- Ask family or friends

- Be specific about amount and repayment

- Put agreement in writing

- Offer to pay small interest if appropriate

- Sell items immediately

- Electronics, jewelry, or valuable items

- Use Facebook Marketplace, OfferUp, or local pawn shops

- Price competitively for quick sale

Emergency Level 2: Need Cash Same Day

Additional options become available:

- Mobile cash advance apps

- Download 2-3 apps simultaneously

- Complete verification process

- Request maximum available amount

- Online payday lenders

- Apply to multiple lenders (rates vary significantly)

- Have documents ready: pay stubs, bank statements, ID

- Choose lenders with same-day funding

- Gig work with instant pay

- Sign up for food delivery, rideshare, or task-based work

- Complete background check process

- Start working and cash out earnings immediately

Emergency Level 3: Need Cash Within 24-48 Hours

More options and better rates available:

- Personal loans from online lenders

- Better rates than payday loans

- Larger amounts available ($1,000-$50,000)

- Fixed repayment terms

- Credit union emergency loans

- Join a credit union if eligible

- Apply for emergency or signature loans

- Much better rates than payday options

- Peer-to-peer lending

- Prosper, LendingClub, or Upstart

- More competitive rates

- Longer repayment terms

Understanding the True Cost of Instant Cash Advance

Before you commit to any advance, you need to understand what you’re really paying. The marketing might say “low fees,” but the annual percentage rate (APR) tells the real story.

Breaking Down the Numbers

Credit Card Instant Cash Advance Example:

- Amount borrowed: $500

- Cash advance fee: $25 (5%)

- Interest rate: 28% APR

- If repaid in 30 days: Total cost = $536.67

Payday Loan Example:

- Amount borrowed: $500

- Fee: $75 (typical $15 per $100 borrowed)

- Term: 14 days

- APR: 391%!

- Total repayment: $575

Cash Advance App Example (Earnin):

- Amount borrowed: $500

- Fee: $0-8 (optional tip)

- APR: 0% if you tip $5 = 26% APR equivalent

- Much better than alternatives!

Hidden Costs to Watch For

Automatic Renewals Many lenders automatically roll over loans if you can’t repay on time. This creates a debt spiral that’s hard to escape.

Processing Fees Some lenders charge additional fees for faster processing or electronic transfers.

Insufficient Fund Fees If automatic repayment fails, you’ll face bank overdraft fees on top of lender penalties.

Credit Score Impact: While most cash advances don’t require credit checks, defaulting can hurt your credit score if the debt goes to collections.

Smart Strategies to Minimize Costs

Compare Multiple Options

Never take the first offer. Rates and terms vary dramatically between providers.

Create a comparison chart:

- Amount available

- Total cost (fees + interest)

- Repayment timeline

- Automatic renewal policies

- Customer reviews and ratings

Time Your Application Strategically

Best times to apply:

- Early in the week (faster processing)

- Morning hours (before daily limits reached)

- When you have recent pay stubs available

Avoid:

- Late Friday applications (delayed until Monday)

- Holiday weekends

- End of month when providers might tighten approvals

Negotiate When Possible

With employers: Ask about emergency hardship programs or one-time payroll advances With banks: Request temporary overdraft increase or emergency line of credit With family: Offer to pay interest to make it more formal and fair

Alternatives to Consider Before Getting an Instant Cash Advance

Sometimes the best solution isn’t borrowing money at all.

Immediate Alternatives

Negotiate payment plans with creditors, utilities, or service providers. Many companies prefer payment arrangements over lost customers.

Sell unused items around your house. Check your closets, garage, and storage areas for valuable items you can sell quickly.

Pick up immediate work through TaskRabbit, Fiverr, or local odd jobs. One day of work might solve your cash flow problem.

Use community resources like food banks, utility assistance programs, or local charities to free up money for your emergency.

Building Future Financial Resilience

Start an emergency fund even if you can only save $5 per week. Small amounts add up over time.

Automate savings by setting up automatic transfers to a separate savings account on payday.

Track your spending to identify areas where you can cut back and redirect money to emergency savings.

Increase your income through side hustles, asking for raises, or developing new skills that command higher pay.

Red Flags: Scams and Predatory Lenders

The cash advance industry attracts both legitimate companies and dangerous predators. Here’s how to protect yourself.

Warning Signs of Scams

Upfront fees before receiving money No physical address or legitimate contact information Guarantees approval regardless of credit or income Requests for gift cards or wire transfers Pressure tactics to sign immediately No written contract or terms disclosure

Legitimate Lender Characteristics

Licensed in your state (check your state’s financial regulator website) Clear terms written in plain English Physical address and working customer service Reasonable requirements for approval Transparent fees disclosed upfront Positive customer reviews from verified sources

Protecting Yourself

Never give personal information until you’ve verified the lender’s legitimacy Read all terms carefully before signing anything Keep copies of all documents and communications Report suspicious activities to your state attorney general’s office

Legal Considerations and Your Rights

Understanding your rights helps you make informed decisions and avoid predatory practices.

State Regulations

Cash advance laws vary significantly by state:

Some states cap interest rates and fees Others prohibit payday lending entirely Many require specific disclosures and cooling-off periods Consumer protection laws provide remedies for unfair practices

Your Rights as a Borrower

Right to clear disclosure of all terms, fees, and costs Right to cancel within specified timeframes (varies by state) Right to complain to state regulators about unfair practices Right to fair collection practices if you default

What to Do If Things Go Wrong

Document everything – keep records of all interactions Contact the lender first to try resolving disputes File complaints with state regulators and the Consumer Financial Protection Bureau Seek help from nonprofit credit counseling services Consider legal assistance for serious violations of your rights

Making the Decision: Is an Instant Cash Advance Right for You?

Before you apply, honestly assess your situation using this framework.

When Cash Advances Make Sense

True emergencies where delay could cause greater harm or expense One-time situations that won’t recur monthly When you have a clear repayment plan and timeline If the cost is less than alternatives (like bounced check fees or late payment penalties)

When to Avoid Cash Advances

Recurring monthly shortfalls (indicates larger budget problems) Non-essential purchases or wants versus needs When you’re already behind on other debts If you don’t have a realistic repayment plan

The Decision Framework

Ask yourself these critical questions:

- Is this a true emergency? Will delay cause significant harm?

- Have I exhausted free or lower-cost alternatives?

- Do I have a realistic plan to repay without creating new problems?

- Am I borrowing an amount I can realistically afford?

- Do I understand all costs and terms involved?

If you answered “no” to any of these questions, reconsider whether a cash advance is your best option.

Building Your Financial Safety Net

The best time to prepare for emergencies is before they happen. Here’s how to build financial resilience for the future.

Emergency Fund Basics

Start small – even $25 makes a difference Automate savings to remove temptation to skip Keep it separate from checking accounts Make it accessible but not too easy to spend

Income Diversification

Develop side hustles that can provide quick income when needed Build marketable skills that command higher wages Create passive income streams through investments or rental properties Maintain good relationships with employers and professional networks

Smart Money Management

Use budgeting apps to track spending and identify savings opportunities Negotiate bills regularly to reduce monthly expenses Build good credit to access better loan terms when needed Stay educated about personal finance through books, podcasts, and reputable websites

Conclusion: Your Path to Financial Empowerment

Getting an instant cash advance can provide crucial relief during emergencies, but it’s not a long-term solution to financial challenges. The key is using these tools wisely while building stronger financial foundations for the future.

Remember these essential points:

Speed costs money – instant access means higher fees and interest rates Compare all options before choosing any single provider Read terms carefully and understand total repayment costs Have a repayment plan before you borrow Build emergency savings to reduce future dependence on advances

Whether you need $100 for groceries or $1,000 for car repairs, multiple options exist to get cash quickly. Mobile apps often provide the best combination of speed and affordability for smaller amounts, while credit card advances offer immediate access for larger sums.

The most important step? Take action to build your financial resilience starting today. Even small steps toward emergency savings and financial education will pay dividends when the next unexpected expense arises.

Your financial future depends not just on navigating today’s emergency, but on building systems that prevent future crises. Start with solving your immediate need, then commit to building the financial safety net that will protect you going forward.

Remember: You have more options and power than you might realize. Use them wisely, and take control of your financial destiny one decision at a time.

Important financial warning:

Instant cash advances are designed for short-term use. Frequent use can signal deeper financial stress and may increase overall costs through fees, tips, or subscriptions.

Are instant cash advances the same as payday loans?

No. While both offer quick access to cash, cash advance apps often have lower fees and more flexible repayment structures. However, costs can still add up.

How fast can I receive an instant cash advance?

Some apps offer same-day or instant transfers, depending on eligibility and payment method, though instant options may include additional fees.