Not all cash advance apps rely on Plaid to connect to your bank account.

Based on my experience reviewing and testing personal finance apps, many users actively avoid Plaid due to privacy concerns, past connection issues, or unsupported banks.

This guide focuses specifically on cash advance apps that do NOT use Plaid, explaining:

Which users these apps are actually suitable for?

How they verify income or eligibility instead?

What trade-offs you should expect?

I’m going to show you everything about cash advance apps that don’t use Plaid: why avoiding Plaid matters, which apps provide alternatives, how they verify your identity instead, and which option best fits your needs. Whether you’re concerned about privacy, had bad experiences with Plaid, or simply want more control over your financial data, these alternatives offer genuine solutions without compromising on speed or convenience.

Why Cash Advance Apps That Don’t Use Plaid Matter

Let’s start with why you might want cash advance apps that don’t use Plaid in the first place.

What Is Plaid and Why People Avoid It

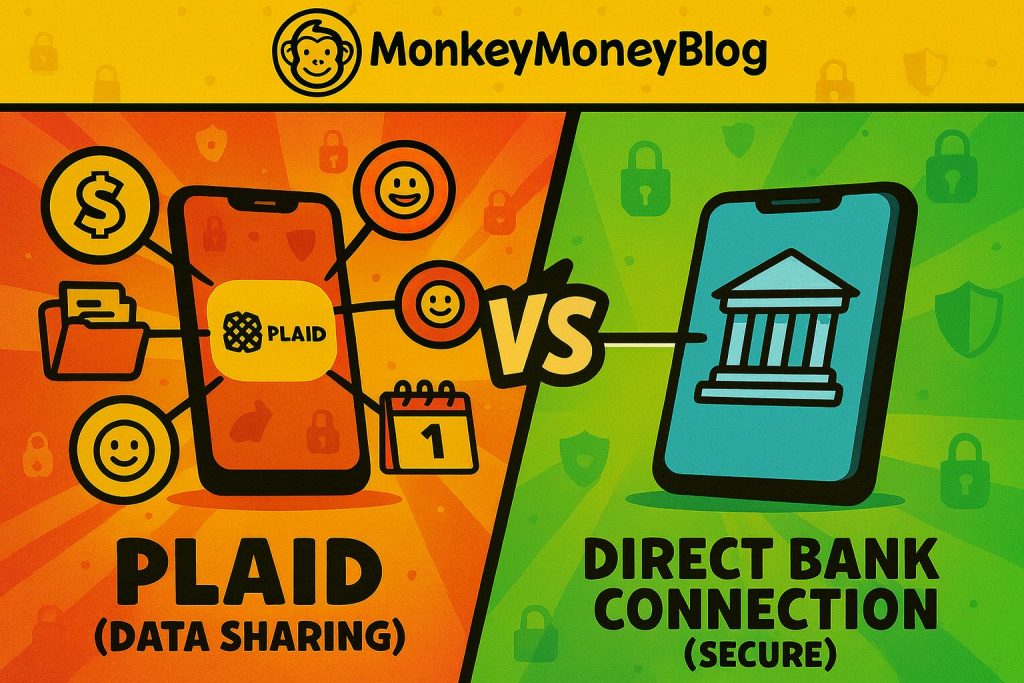

Plaid is a financial technology company that acts as a middleman between apps and your bank. When an app uses Plaid, you’re essentially giving Plaid your bank login credentials so it can access your account information.

How Plaid Works:

- You enter your bank username and password into Plaid’s interface

- Plaid logs into your bank account on your behalf

- Plaid collects transaction data, balance information, and account details

- Plaid shares this data with the app you’re trying to use

The Problems: Many people feel uncomfortable with this arrangement. You’re giving a third-party company complete access to your banking information. Even though Plaid claims to be secure, you’re multiplying the points of potential failure.

Privacy Concerns with Plaid

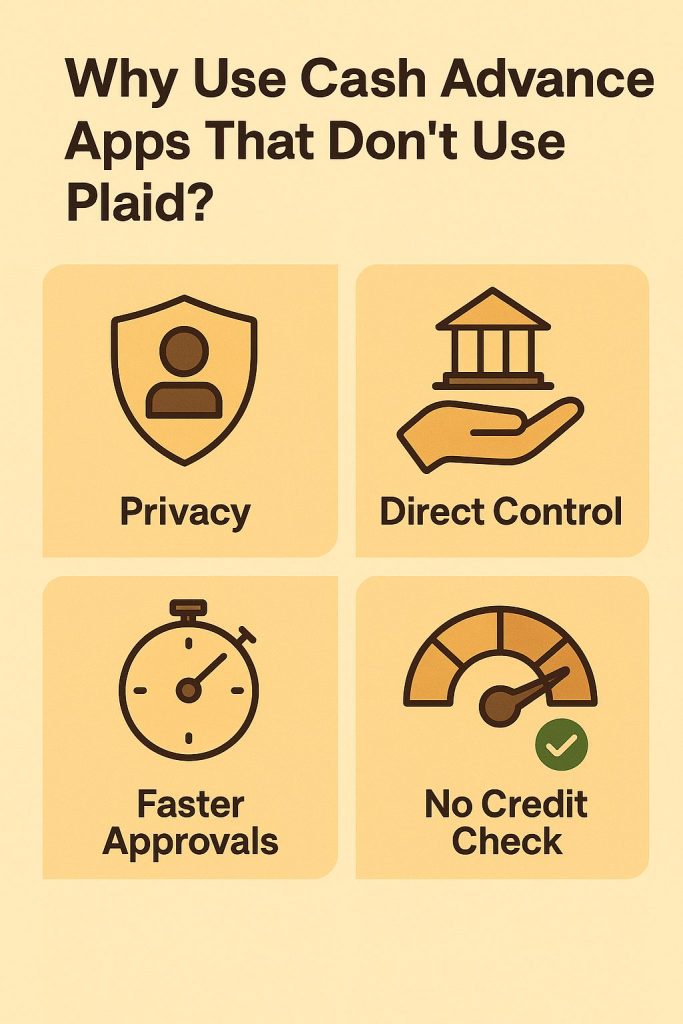

Cash Advance Apps That Don’t Use Plaid address several legitimate privacy concerns.

Data Collection: Plaid doesn’t just verify your identity and move on. It continues accessing your transaction data, often storing years of financial history. This creates a detailed profile of your spending habits, income sources, and financial behavior.

Third-Party Access: When you use Plaid, you’re trusting not just the app you intended to use, but also Plaid itself. That’s an additional company with access to sensitive financial information.

Security Risks: Sharing your actual bank login credentials—even with a supposedly secure intermediary—violates most banks’ terms of service and could complicate things if unauthorized access occurs.

Why Cash Advance Apps That Don’t Use Plaid Are Growing

The market for Cash Advance Apps That Don’t Use Plaid is expanding because users are demanding better options.

Increased Awareness: More people understand what they’re agreeing to when they use Plaid. This awareness drives demand for alternatives.

Bank Partnerships: Many cash advance apps that don’t use Plaid have developed direct partnerships with banks, creating verification methods that don’t require sharing login credentials.

Regulatory Pressure: Regulators are increasingly scrutinizing data aggregators like Plaid, encouraging the development of more secure alternatives.

The Best Cash Advance Apps That Don’t Use Plaid

Why trust this list?

I analyze financial apps based on verification methods, fees, eligibility requirements, and user risk. This list is updated manually and focuses on apps that either:

- Use alternative bank connections

- Verify income through employment data

- Offer advances without full bank syncing

Let me break down the top options for cash advance apps that don’t use Plaid, including what makes each unique.

| App Name | Uses Plaid | How Eligibility Is Verified | Max Cash Advance | Key Notes |

|---|---|---|---|---|

| Earnin | No | Employment verification, pay schedule, debit card | Up to $100/day | Requires steady income, no mandatory fees |

| Dave | No | Bank login or debit card connection | Up to $500 | Small monthly membership fee |

| MoneyLion | No | Account connection and income activity | Up to $500 | Uses internal account linking, not Plaid |

| Klover | No | Employment data and user activity | Up to $200 | Optional tips and data-sharing model |

| Albert | No | Bank credentials and income patterns | Up to $250 | Requires Genius subscription for advances |

Do cash advance apps that don’t use Plaid still require a bank account?

Most cash advance apps still require some form of bank account or debit card, even if they don’t use Plaid. These apps may rely on direct login credentials, employment verification, or transaction history instead.

Why do some cash advance apps avoid Plaid?

Some apps avoid Plaid due to privacy concerns, bank compatibility issues, or because they use alternative verification systems tailored to their platform.

Are cash advance apps without Plaid safer?

Not necessarily. Safety depends on the app’s data handling, fees, and repayment terms—not whether Plaid is used. Always review terms carefully before using any cash advance service.

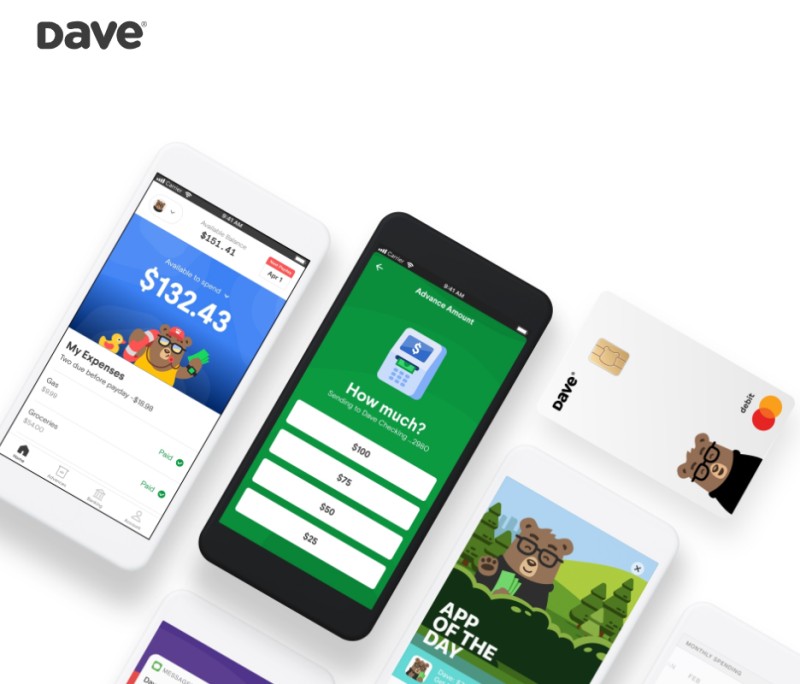

Dave: Simple and Transparent

Dave is one of the most popular cash advance apps that don’t use Plaid, offering a straightforward approach to emergency funds.

How Dave Works Without Plaid: Dave uses direct deposit verification through your employer or connects to your bank via secure, bank-provided APIs, rather than Plaid. You link your checking account, but Dave doesn’t require your bank login credentials.

Key Features:

- Cash advances up to $500

- No interest charges

- Optional tips to support the service

- Builds credit through Dave Banking

- Side hustle finder to earn extra money

Costs: Dave charges a $1 monthly membership fee. You can also leave optional tips on advances, but they’re not required.

Eligibility Requirements:

- Regular income (employment or benefits)

- Active checking account

- Direct deposit preferred but not mandatory

Pros:

- Low cost compared to alternatives

- Quick approval process

- No credit check required

- Extra features like budgeting tools

Cons:

- Lower advance amounts for new users

- Must have consistent income

- Advance limits increase gradually with usage

Earnin: Pay for Hours Worked

Earnin takes a unique approach among cash advance apps that don’t use Plaid by focusing on hours you’ve already worked.

How Earnin Avoids Plaid: Earnin tracks your work hours through various methods—GPS location if your workplace is verified, or you can submit timesheets. It connects to your bank for deposit verification but doesn’t use Plaid’s credential-sharing model.

Key Features:

- Access up to $100 per day, $750 per pay period

- Cash out based on hours worked

- Lightning Speed option for instant transfers

- Balance Shield helps avoid overdraft fees

- Health aid for medical bill assistance

Costs: Earnin operates on a “tip what you think is fair” model. There are no mandatory fees, but tips are strongly encouraged. Lightning Speed transfers cost $1.99-$3.99.

Eligibility Requirements:

- Regular workplace or submitted timesheets

- Direct deposit to checking account

- Verifiable work schedule

Pros:

- No mandatory fees

- High advance limits

- Fast access to earned wages

- Helpful overdraft protection

Cons:

- Tips add up over time

- Requires tracking work hours

- Only works with W-2 employment

- Lower limits if you don’t enable direct deposit tracking

MoneyLion: Comprehensive Financial Platform

MoneyLion stands out among cash advance apps that don’t use Plaid by offering a complete financial ecosystem beyond just advances.

How MoneyLion Works: MoneyLion’s Instacash feature provides advances without Plaid by using direct bank connections through secure APIs. You can also use RoarMoney, their banking product, for instant access without any external verification.

Key Features:

- Instacash advances up to $500

- No interest or credit checks

- Credit Builder Plus for building credit

- Managed investing accounts

- Financial tracking and advice

Costs: Basic Instacash is free for amounts up to $100. Larger amounts and faster transfers require a membership at $19.99/month, which includes additional features.

Eligibility Requirements:

- Regular income source

- Checking account

- Qualifying direct deposit increases limits

Pros:

- High advance limits

- Multiple financial products in one app

- No credit impact

- Build credit while using other features

Cons:

- Expensive monthly membership for full features

- Free tier has lower limits

- May take time to unlock maximum advance amounts

Brigit: Budget-Focused Advances

Brigit is among the cash advance apps that don’t use Plaid that emphasize helping users avoid financial emergencies altogether.

Brigit’s Verification Method: Brigit connects directly to your bank through secure APIs provided by financial institutions. You verify your identity through document upload and bank account verification, but never share login credentials.

Key Features:

- Cash advances up to $250

- Automatic advances to prevent overdrafts

- Finance Helper tool for budgeting

- Credit Builder to establish credit history

- Identity theft protection

Costs: Brigit offers a free plan with limited features. The paid plan costs $9.99/month and includes larger advances and predictive alerts.

Eligibility Requirements:

- Regular income of at least $1,500/month

- Active checking account for 60+ days

- Consistent positive balance history

Pros:

- Predictive overdraft alerts

- Automatic advances prevent fees

- Affordable monthly cost

- Good budgeting tools included

Cons:

- Lower maximum advance amounts

- Income requirements exclude some users

- Subscription required for meaningful advances

Possible Finance: Builds Credit History

Possible Finance takes a different approach among cash advance apps that don’t use Plaid by actually reporting to credit bureaus.

How Possible Avoids Plaid: Possible uses manual bank account verification through micro-deposits and document submission. This process takes slightly longer but doesn’t require sharing bank credentials.

Key Features:

- Loans from $50 to $500

- Four biweekly payments

- Reports to credit bureaus

- No credit score required

- Same-day funding available

Costs: Loans cost $3-$8 per $100 borrowed, depending on your state. This works out to an APR between 150-200%, which is high but lower than payday loans.

Eligibility Requirements:

- Checking account open 3+ months

- Income of at least $750/month

- Resident of participating state

Pros:

- Builds credit history

- Manageable payment plans

- Works with poor or no credit

- Clear fee structure

Cons:

- Higher cost than other options

- Not available in all states

- Longer approval process

- Still relatively expensive borrowing

Chime SpotMe: Bank Feature Alternative

While not a standalone app, Chime’s SpotMe feature functions as one of the cash advance apps that don’t use Plaid by being integrated directly into their banking service.

How SpotMe Works: Since Chime is your actual bank, there’s no third-party verification needed. SpotMe allows overdrafts up to your limit without fees.

Key Features:

- Overdraft up to $200 with no fees

- Automatic coverage on eligible purchases

- Early direct deposit (up to 2 days early)

- No monthly maintenance fees

- Automatic savings features

Costs: SpotMe is completely free with no interest or fees. Chime makes money from merchant interchange fees, not customer fees.

Eligibility Requirements:

- Chime Checking Account

- Regular direct deposits of $200+/month

- Good standing account history

Pros:

- Completely free

- No separate app needed

- Instant coverage

- Part of full banking solution

Cons:

- Must switch banks to Chime

- Requires consistent direct deposits

- Lower limits initially

- Not technically a cash advance app

How This Cash Advance Apps That Don’t Use Plaid Verify You

If these cash advance apps that don’t use Plaid aren’t using Plaid’s verification, how do they confirm your identity and income?

Direct Bank API Connections

Many cash advance apps that don’t use Plaid connect directly to banks through official APIs (Application Programming Interfaces) that banks themselves provide.

How This Works:

- Banks offer official API access to approved partners

- Apps authenticate through OAuth (you approve access without sharing credentials)

- The bank confirms your identity and account details directly

- No third party sees your banking username and password

Benefits: This method is actually more secure than Plaid because you’re not sharing login credentials with anyone. The bank controls what information is shared and can revoke access anytime.

Manual Verification Methods

Some cash advance apps that don’t use Plaid use traditional verification methods that are more time-consuming but don’t require data aggregators.

Document Upload:

- Bank statements from the last 2-3 months

- Pay stubs proving income

- Photo ID for identity verification

- Sometimes a selfie for biometric confirmation

Micro-Deposit Verification:

- App sends two small deposits to your account (like $0.17 and $0.23)

- You confirm the exact amounts

- This proves you have access to the account

- Takes 1-3 business days

Direct Deposit Tracking

Many cash advance apps that don’t use Plaid verify income through direct deposit monitoring.

How It Works:

- You authorize the app to monitor incoming deposits

- The app uses read-only access through secure bank APIs

- It identifies regular paycheck patterns

- Advances are based on verified income history

Why This Works: Direct deposits from employers are strong proof of income. Apps can confidently advance money knowing a paycheck is incoming.

Employment Verification Services

Some cash advance apps that don’t use Plaid partner with employment verification services.

The Process:

- You provide employer information

- The app verifies employment through payroll service providers (like ADP)

- Income confirmation happens without accessing your bank

- Updates automatically with each paycheck

Advantages: This method completely bypasses bank account access while still confirming income, making it appealing for users prioritizing privacy.

Comparing Features of Cash Advance Apps That Don’t Use Plaid

Let me break down how these cash advance apps that don’t use Plaid compare across key factors.

Maximum Advance Amounts

| App | Maximum Amount | Time to Maximum |

|---|---|---|

| Earnin | $750 per pay period | Immediately with qualifying direct deposit |

| MoneyLion | $500 | Several pay periods with membership |

| Dave | $500 | Gradually increases over time |

| Brigit | $250 | Available with paid membership |

| Possible Finance | $500 | Based on state and income |

| Chime SpotMe | $200 | Increases with direct deposit history |

Insight: Earnin offers the highest immediate limit among cash advance apps that don’t use Plaid, but MoneyLion and Dave can match it with sustained use.

Speed of Fund Access

Fastest Options: Earnin’s Lightning Speed and MoneyLion’s Turbo Transfer provide funds in minutes, though both charge fees for instant access.

Standard Timing: Most cash advance apps that don’t use Plaid deliver funds within 1-3 business days for free. This is adequate for non-emergency situations.

Planning Ahead: The key with these apps is requesting advances before you desperately need them, allowing time for standard transfers.

Total Cost Comparison

Lowest Cost:

- Earnin: Technically free with optional tips

- Chime SpotMe: Completely free

- Dave: $1/month subscription

Moderate Cost:

- Brigit: $9.99/month for useful features

- Possible Finance: $3-8 per $100 borrowed

Highest Cost:

- MoneyLion: $19.99/month for InstacashPlus

Real-World Comparison: If you use an advance once monthly, Dave costs $12/year versus Brigit’s $119.88/year. However, Brigit offers more robust features that might justify the cost.

Credit Building Opportunities

Only some cash advance apps that don’t use Plaid help build credit:

Reports to Credit Bureaus:

- Possible Finance (reports installment loan payments)

- MoneyLion (Credit Builder Plus feature)

- Dave (through Dave Banking)

Doesn’t Impact Credit:

- Earnin (no credit reporting)

- Brigit (optional Credit Builder)

- Chime SpotMe (not reported)

Why This Matters: If you’re trying to establish or rebuild credit, choosing cash advance apps that don’t use Plaid but do report positive payment history provides dual benefits.

Who Should Use Cash Advance Apps That Don’t Use Plaid

These alternatives aren’t for everyone. Let me help you determine if cash advance apps that don’t use Plaid fit your situation.

Perfect Candidates

Privacy-Conscious Users: If you’re uncomfortable with data aggregation services accessing your financial information, cash advance apps that don’t use Plaid respect your boundaries while still providing needed services.

Previous Plaid Problems: Some users have experienced issues with Plaid disconnecting, requiring constant re-authentication, or encountering compatibility problems with their banks. These alternatives eliminate that friction.

Security-Focused Individuals: People who prioritize minimizing third-party access to sensitive accounts find cash advance apps that don’t use Plaid more aligned with their security practices.

Bank Policy Concerns: Users whose banks explicitly prohibit sharing login credentials can use these alternatives without violating terms of service.

Less Ideal Situations

Immediate Emergency Needs: If you need money within hours and haven’t used these services before, verification processes for cash advance apps that don’t use Plaid might take too long. Consider having accounts established before emergencies arise.

Complex Income Situations: Irregular income, multiple income sources, or cash-based earnings can make verification challenging for any cash advance service, including those that don’t use Plaid.

Very Low Income: Most cash advance apps that don’t use Plaid require minimum income thresholds. If you’re below these minimums, you might not qualify regardless of verification method.

Maximizing Benefits from Cash Advance Apps That Don’t Use Plaid

Here’s how to get the most value from cash advance apps that don’t use Plaid.

Start Before You Need It

Build History Early: Most cash advance apps that don’t use Plaid increase your available advance amount over time as they observe your income patterns and responsible usage.

Action Step: Download and verify your account now, even if you don’t need an advance currently. When an unexpected expense hits, you’ll already have access to maximum amounts.

Optimize Your Limits

Consistent Direct Deposits: All cash advance apps that don’t use Plaid favor users with predictable direct deposits. If possible, have your paycheck deposited to the linked account rather than having it deposited elsewhere and transferred.

Maintain Positive Balances: Apps track your account health. Frequent overdrafts or negative balances might reduce your available advance amounts.

Prompt Repayment: Even though these aren’t loans, repaying on time (when your paycheck hits) builds trust and increases future availability.

Minimize Costs

Avoid Instant Transfer Fees: Unless it’s truly an emergency, use free standard transfer options when using cash advance apps that don’t use Plaid. Paying $3.99 for instant access on a $100 advance equals an effective 4% fee.

Compare Subscription Costs: Some cash advance apps that don’t use Plaid charge monthly fees. Calculate whether the monthly subscription costs more than you’d pay for occasional instant transfers with fee-per-use services.

Tip Strategically: For apps like Earnin that request tips, consider what’s fair based on your usage. Don’t feel pressured to tip unsustainably, but recognize tips help maintain the service.

Use Complementary Features

Many cash advance apps that don’t use Plaid include additional financial tools.

Budgeting Tools: Use included budgeting features to address why you need advances in the first place. The goal should be building financial stability, not relying permanently on advances.

Overdraft Protection: Features like Brigit’s automatic advances or Chime’s SpotMe can prevent expensive overdraft fees that cost more than the subscription.

Credit Building: If offered, use credit-building features. Establishing credit opens doors to better financial products long-term.

Common Mistakes with Cash Advance Apps That Don’t Use Plaid

Avoid these errors when using cash advance apps that don’t use Plaid.

Mistake 1: Using Multiple Services Simultaneously

The Problem: Taking advances from multiple cash advance apps that don’t use Plaid means multiple repayments hitting your account simultaneously, potentially causing overdrafts.

The Solution: Stick with one primary service. Only use multiple apps if you truly understand your cash flow and can handle coordinated repayments.

Mistake 2: Treating Them Like Free Money

The Problem: Even with low or no fees, advances must be repaid. Some users fall into a cycle of constantly having advances outstanding.

The Solution: Use cash advance apps that don’t use Plaid for genuine emergencies or one-time expenses, not as ongoing income supplements.

Mistake 3: Ignoring Alternative Solutions

The Problem: An advance addresses symptoms but not root causes of financial instability.

The Solution: While using cash advance apps that don’t use Plaid for immediate needs, simultaneously work on building emergency savings, increasing income, or reducing expenses.

Mistake 4: Not Reading Fee Structures

The Problem: Misunderstanding when fees apply or how subscriptions work leads to unexpected costs.

The Solution: Fully understand the pricing model before using any of these cash advance apps that don’t use Plaid. Calculate real costs based on your likely usage patterns.

Mistake 5: Waiting Until the Last Minute

The Problem: Setting up and verifying accounts takes time. In genuine emergencies, you might not have access ready.

The Solution: Establish access to cash advance apps that don’t use Plaid before you need them. Think of it like insurance—you hope not to need it, but it’s there if you do.

Alternatives to Cash Advance Apps That Don’t Use Plaid

Sometimes other solutions might work better than cash advance apps that don’t use Plaid.

Build an Emergency Fund

The Best Solution: Having even $500-1,000 in savings eliminates most needs for cash advances. This should be your long-term goal.

How to Start:

- Save automatically from each paycheck

- Use micro-saving apps that round up purchases

- Direct any windfalls to savings

- Start small—even $25/month adds up

Negotiate with Creditors

Often Overlooked: Many bills can be negotiated or temporarily deferred if you communicate proactively.

Action Steps:

- Call before payments are late

- Explain your situation honestly

- Ask about hardship programs

- Negotiate payment plans

Side Income

Immediate Options: Creating quick additional income might address needs without advances.

Ideas:

- Gig work (delivery, rideshare)

- Sell unused items

- Freelance your skills

- Temporary second job

Credit Union Payday Alternative Loans

Better Than Payday Loans: Federal credit unions offer PAL programs—small loans specifically designed to be affordable alternatives to payday loans.

Features:

- Typically $200-1,000

- 28% APR maximum

- Payment plans up to 6 months

- Reports to credit bureaus

Requirement: You must be a credit union member, which sometimes requires joining fees or meeting eligibility criteria.

The Future of Cash Advance Apps That Don’t Use Plaid

The landscape of cash advance apps that don’t use Plaid is evolving rapidly.

Direct Bank Integration

More banks are developing their own early-pay and advance features, reducing need for external apps.

Examples:

- Bank of America: Balance Assist

- US Bank: Simple Loan

- Huntington Bank: Standby Cash

These bank-provided options function essentially as cash advance apps that don’t use Plaid because they’re direct banking features.

Open Banking Standards

New regulations and standards are emerging that could make Plaid-style intermediaries less necessary.

What’s Coming:

- Secure API standards all banks must support

- Consumer data portability rights

- More transparent data-sharing rules

Impact on Cash Advance Apps That Don’t Use Plaid: These standards might make direct bank connections even easier, potentially expanding the number of cash advance apps that don’t use Plaid.

Earned Wage Access Expansion

More employers are partnering with services to offer early wage access as an employee benefit.

How It Works:

- Employers integrate with providers

- Employees can access earned but unpaid wages

- Often provided at no cost to employees

- Employer-sponsored, so more trustworthy

This trend might reduce overall need for cash advance apps that don’t use Plaid as workplace solutions become more common.

Your Action Plan for Cash Advance Apps That Don’t Use Plaid

Here’s your step-by-step guide to implementing cash advance apps that don’t use Plaid effectively.

Step 1: Assess Your Needs (Week 1)

Questions to Answer:

- How often do you face short-term cash shortfalls?

- What’s your typical shortfall amount?

- How quickly do you need funds when situations arise?

- What features beyond advances would benefit you?

Action: Document the last 6 months of times you could have used an advance. This helps determine which features matter most.

Step 2: Choose Your Primary App (Week 1)

Decision Matrix: Based on your needs assessment, pick one or two cash advance apps that don’t use Plaid that best match your situation.

For Most People: Start with Dave or Earnin—they offer good balance of accessibility, features, and cost.

For Building Credit: Consider Possible Finance or MoneyLion if credit building matters to you.

For Free Solution: If you’re willing to switch banks, Chime with SpotMe offers the most comprehensive free option.

Step 3: Set Up and Verify (Week 2)

Actions:

- Download chosen apps

- Complete verification processes

- Link bank accounts using non-Plaid methods

- Enable direct deposit if required for maximum benefits

- Explore all features available

Timeline: Allow at least a week for complete verification. Some cash advance apps that don’t use Plaid require observing 1-2 pay cycles before offering advances.

Step 4: Use Strategically (Ongoing)

Best Practices:

- Only use for genuine short-term needs

- Request advances early enough for free transfer

- Repay promptly when paycheck arrives

- Track your usage patterns

- Gradually reduce dependency

Step 5: Build Independence (Long-term)

Ultimate Goal: Use cash advance apps that don’t use Plaid as a bridge while building financial stability.

Parallel Actions:

- Automate savings transfers

- Build $500 emergency fund

- Address underlying budget issues

- Increase income where possible

- Reduce reliance on advances over time

Final Thoughts on Cash Advance Apps That Don’t Use Plaid

Cash advance apps that don’t use Plaid offer genuine alternatives for people who value privacy, have concerns about data aggregation, or simply want more direct control over their financial information.

These services aren’t perfect. They still involve costs, either through subscriptions, tips, or fees. They still require repayment. They still shouldn’t become permanent financial solutions.

But here’s what makes cash advance apps that don’t use Plaid valuable: they provide emergency access to funds without compromising your banking credentials or creating extensive data-sharing relationships.

The best approach? Choose one or two cash advance apps that don’t use Plaid that fit your situation. Set them up now, before emergencies strike. Use them judiciously for genuine short-term needs. And simultaneously work toward building financial stability that reduces your need for any advance services.

Because ultimately, the best cash advance app is the one you don’t need to use because you’ve built sufficient savings and income stability. But until you reach that point, these tools can help you avoid expensive overdrafts, predatory payday loans, and financial disasters.

The power is in your hands. You can access emergency funds without sacrificing your privacy or sharing banking credentials with third-party data aggregators.

Choose wisely. Use responsibly. Build stability.

Your financial data belongs to you. Cash advance apps that don’t use Plaid let you keep it that way.